AEPS India is leading service provider of aeps and micro atm services and solution. Aepsindia offer micro atm service with software and mobile application.

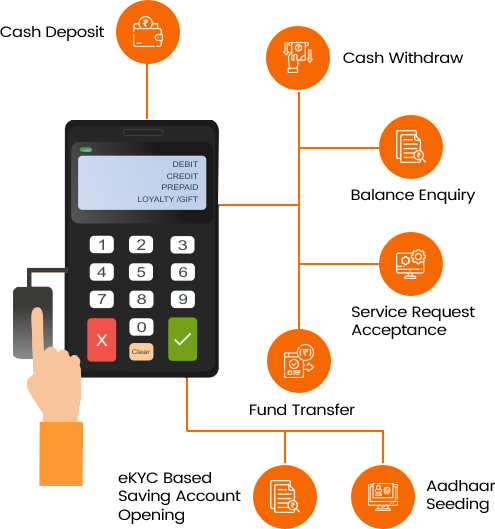

Aepsindia offers best Micro ATM service with software, mobile app and micro ATM devices. Best part of micro ATMs are best commission on cash withdrawal, portable device, easy to use. Micro ATM devices accept all bank cards and biometrics secure transaction for cash withdrawal. Micro ATM also known as mini ATM. It is differ then POS machine. Micro-ATM Solution that will enable Banks Businesss Correspondents (BC) with biometric device to offer customers to do basic banking services and financial transactions like deposit, withdrawal, payment (fund transfer), balance enquiry and mini statement. The platform will enable Businesss Correspondents (could be a local kirana store owner) for instant transactions.

The micro atm platform will enable a person to instantly deposit or withdraw funds. This device will be based on a mobile phone connection and would be made available at sore or shop of every Businesss Correspondents (BC). Customers would just have to get their identity authenticated and withdraw or deposite money from bank accounts. This money will manage from the cash drawer of the Businesss Correspondents (BC). Essentially, the basic transaction types, to be supported by micro ATM, are deposit, withdrawal, payment, Fund transfer, balance enquiry and mini statement.

Aeps india is providing best Micro-ATM Solution which is fast, secure and easy to use.

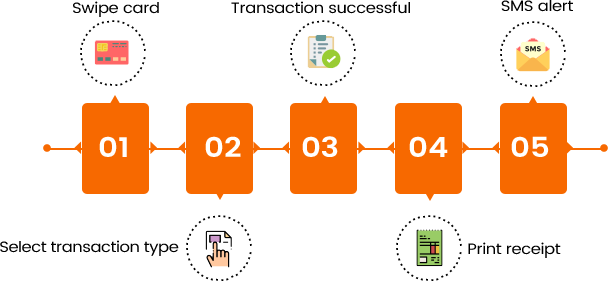

To operate this portal, a person has to undergo verification process such as Aadhaar card with fingerprint scanning or card swipe option. Once verified, he or she will be able to select options for various transactions like - cash deposit, fund transfer, eKYC based saving account, Aadhaar seeding, cash withdrawal, balance enquiry and service request acceptance. For carrying a transaction all you have to do is select the option as per your requirement, then a message will be displayed on the screen and print receipt is generated. After the transaction, a person will as usual receive confirmation from their bank about the transaction via SMS.

To operate this portal, a person has to undergo verification process such as Aadhaar card with fingerprint scanning or card swipe option. Once verified, he or she will be able to select options for various transactions like - cash deposit, fund transfer, eKYC based saving account, Aadhaar seeding, cash withdrawal, balance enquiry and service request acceptance. For carrying a transaction all you have to do is select the option as per your requirement, then a message will be displayed on the screen and print receipt is generated. After the transaction, a person will as usual receive confirmation from their bank about the transaction via SMS.